Business Insurance in and around Chesapeake

One of Chesapeake’s top choices for small business insurance.

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jessica Hester help you learn about quality business insurance.

One of Chesapeake’s top choices for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

If you're looking for a business policy that can help cover buildings you own, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Reach out to the wonderful team at agent Jessica Hester's office to discover the options that may be right for you and your small business.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

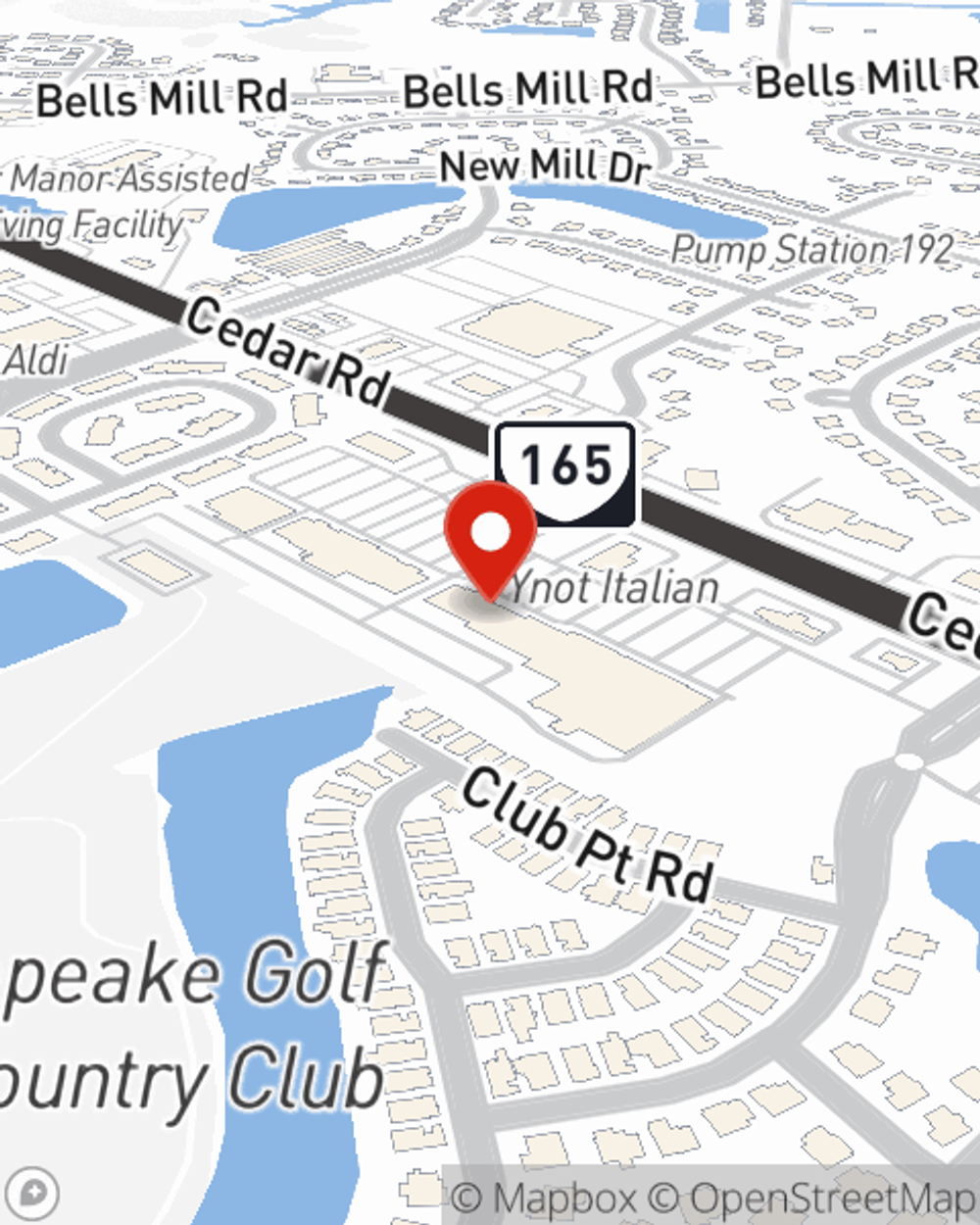

Jessica Hester

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.